Introduction:

Predicting future trends and market shifts in the dynamic world of finance is like trying to navigate a maze of unknowns. But among the complexity, one shining example of technical progress appears: neural networks. Neural Networks are at the forefront of financial forecasting, utilizing artificial intelligence to transform how we examine pricing data and identify possibilities. We set out on a quest to demystify Neural Networks for Financial Forecasting in this extensive tutorial, illuminating their complex inner workings and useful applications.

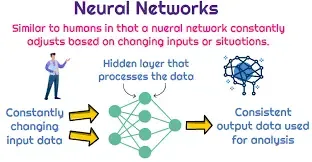

Introduction to Neural Networks:

Using cutting-edge technologies to get insights into market behaviors and trends is at the core of modern finance. In this group of technologies, neural networks are the most advanced. To put it briefly, Neural Networks are computer models that draw inspiration from the composition and operation of the human brain. They are made up of interconnected neurons, or nodes, arranged in layers, each of which has a distinct purpose.

In his groundbreaking study "Neural Networks for Financial Forecasting," Edward Gately explores the possibilities of applying neural networks to the complicated world of financial markets. Gately illustrates how neural networks may be trained to identify patterns in huge datasets, allowing for precise predictions and well-informed decision-making. He focuses on the conventional Backpropagation algorithm.

Understanding Neural Network Architecture:

Understanding the architecture of neural networks is essential before diving into the nuances of financial forecasting. These networks consist of output, hidden, and input layers. By preparing the incoming data for analysis, data preprocessing establishes the groundwork. In order to reduce errors and improve accuracy, the network's parameters must be adjusted during training. In order to ensure robustness and reliability, testing and validation confirm the network's performance on unknown data.

Neural Networks in Financial Forecasting:

Predictive analytics is entering a new age with the integration of neural networks in finance. With their unmatched ability to reveal latent patterns and trends, neural networks are being used for everything from time series forecasting to economic forecasts. These networks do exceptionally well at activities like stock market analysis, risk assessment, and foreign currency forecasts because they make use of sophisticated algorithms and computing capacity.

Enhancing Forecast Accuracy:

Prediction accuracy is one of the most important measures when assessing neural networks for financial forecasting. Neural Networks aim to improve accuracy and dependability through iterative refinement and optimization. Prediction capabilities are further enhanced by methods like unsupervised clustering and recurrent neural networks (RNNs), including variations like Long Short-Term Memory (LSTM), which allow for more accurate and nuanced forecasts.

The Future of Financial Forecasting:

Finance forecasting is a field that is always changing along with technology. We are witnessing a paradigm shift in the way we understand and forecast market dynamics, with Neural Networks leading the charge. The convergence of machine learning and finance creates opportunities for never-before-seen insights and well-informed decision-making, which benefits both investors and institutions.

Conclusion:

To sum up, neural networks are a major advancement in the field of financial forecasting because they provide a powerful combination of precision, flexibility, and effectiveness. These sophisticated algorithms expand the possibilities of predictive analytics, enabling it to do everything from price data analysis to market trend analysis. Neural Networks are innovative lights that guide us through the complex landscape of financial markets and point the way to a better informed and wealthy future.

FAQs:

1. How do Neural Networks differ from Conventional Forecasting Techniques? Beyond the limitations of conventional methods, Neural Networks use sophisticated algorithms and computer capacity to analyze large datasets and reveal hidden patterns.

2. What role do neural networks have in making financial decisions? Neural Networks enable investors and financial institutions to make well-informed decisions, minimizing risks and optimizing profits, by offering precise forecasts and insights into market movements.

3. Can Neural Networks be used to forecast financial data for all purposes? Although Neural Networks are highly effective in many areas, including time series forecasting and economic predictions, their applicability is contingent upon a number of criteria, including domain expertise, model complexity, and data quality.

4. Is it possible for neural networks to change with the market? Indeed, through ongoing learning and optimization, neural networks can adjust to changing market dynamics, guaranteeing forecasting's robustness and dependability.